By incorporating Nasdaq’s surveillance algorithms, the CFTC is representing a Wall Street veteran to police the digital edge, targeting to bring conventional market morality to the traditionally unstructured crypto space.

The U.S. Commodity Futures Trading Commission (CFTC) has disclosed a huge upgrade to its marketplace supervision systems, embracing Nasdaq’s superior Market Surveillance platform to higher detect fraud, insider trading, and manipulation throughout derivatives and digital asset markets.

The device went live on August 27, 2025, underneath the management of Acting Chair Caroline D. Pham, and changes the CFTC’s legacy 1990s-technology supervising infrastructure.

CFTC to start being a ‘21st Century Regulator’ With Nasdaq Market Surveillance

The upgrade reaches at a important moment for U.S. Regulators as Congress balance the Financial development and Technology for the 21th Century Act, which can enlarge the CFTC’s jurisdiction over spot digital asset markets.

In announcing the release, Pham stated the technology indicates a big step toward changing the CFTC right into a “21st century regulator.”

“As our markets persist to develop and combine new technology, it’s vital that the CFTC remains forward of the curve,” Pham stated.

Pham delivered that “Nasdaq Market Surveillance will, for the first time, gives the CFTC with computerized alerts and cross-market analytics with a view to better secure our markets from fraud, manipulation and abuse. This will permit our staff to be aware of unusual or problematic trading activity more productively and take action more quickly.”

The move comes as the CFTC confronts escalating pressure to reinforce its supervision of the fast-developing digital asset sector.

The agency, traditionally accountable for derivatives tied to commodities, currencies, and fixed income, has taken on a bigger position in policing crypto markets amid efforts in Washington to close regulatory gaps.

A recent White House report urged Congress to grant the CFTC precise authority over spot markets for non-protection digital assets, underscoring the need for modern-day surveillance tools.

Notably, Nasdaq Market Surveillance is formerly deployed via more than 50 exchanges and 20 international regulators, making it the most broadly used surveillance technology in worldwide markets.

The platform gives regulators with included monitoring across asset classes, real-time data analysis, and automated alerts capable of emphasizing ability insider trading, wash trading, and other market abuses.

Its expandable structure allows regulators to oversee period of extreme uncertainly, even as get right to distinct order book data lets in for granular trade-through-trade scrutiny.

Tal Cohen, President at Nasdaq, said the partnership with the CFTC indicates the significants of superior monitoring tools in a unexpectedly developing market.

“Today’s financial markets need surveillance technology that could adapt to increasing regulatory evolution and emerging asset classes,” he stated. “We’re proud to partner with the CFTC and assist their venture to sell the integrity, resilience, and vibrancy of U.S. Derivatives markets.”

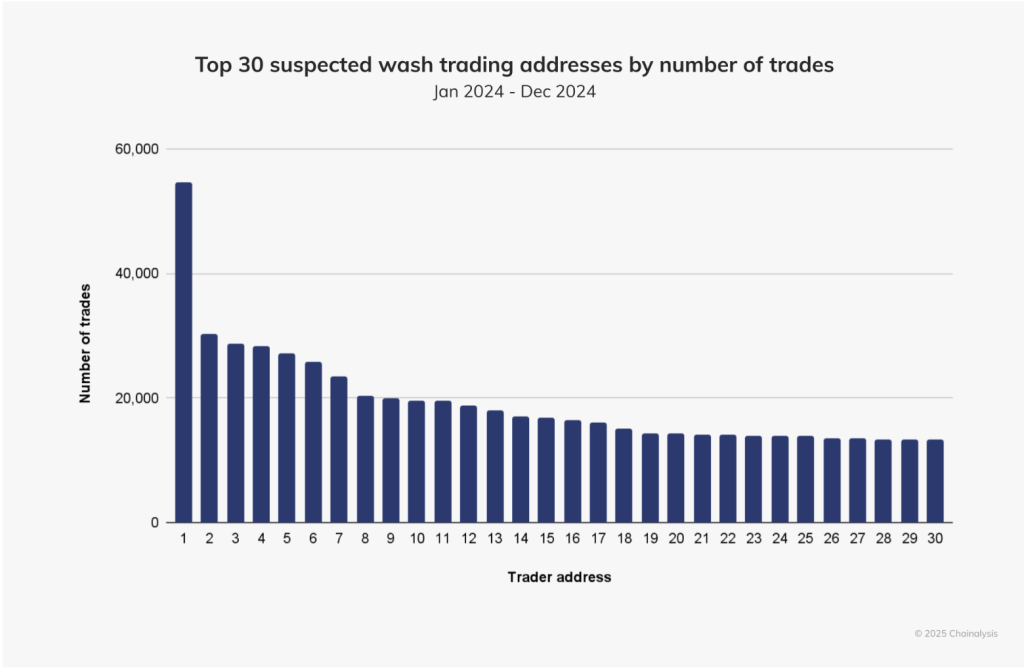

At the identical time, worries over manipulation in crypto markets are rising. A latest Chainalysis document anticipated that wash trading on select blockchain networks accounted for as much as $2.57 billion in volume, with a small variety of actors driving the majority of activity.

Pump-and-dump schemes have also surged, fueled with the aid of meme coins and low-price trading on new blockchains.

Researchers warned that such activity is often tied to pump-and-dump schemes, in which token creators expand volumes to trap investors before selling off holdings.

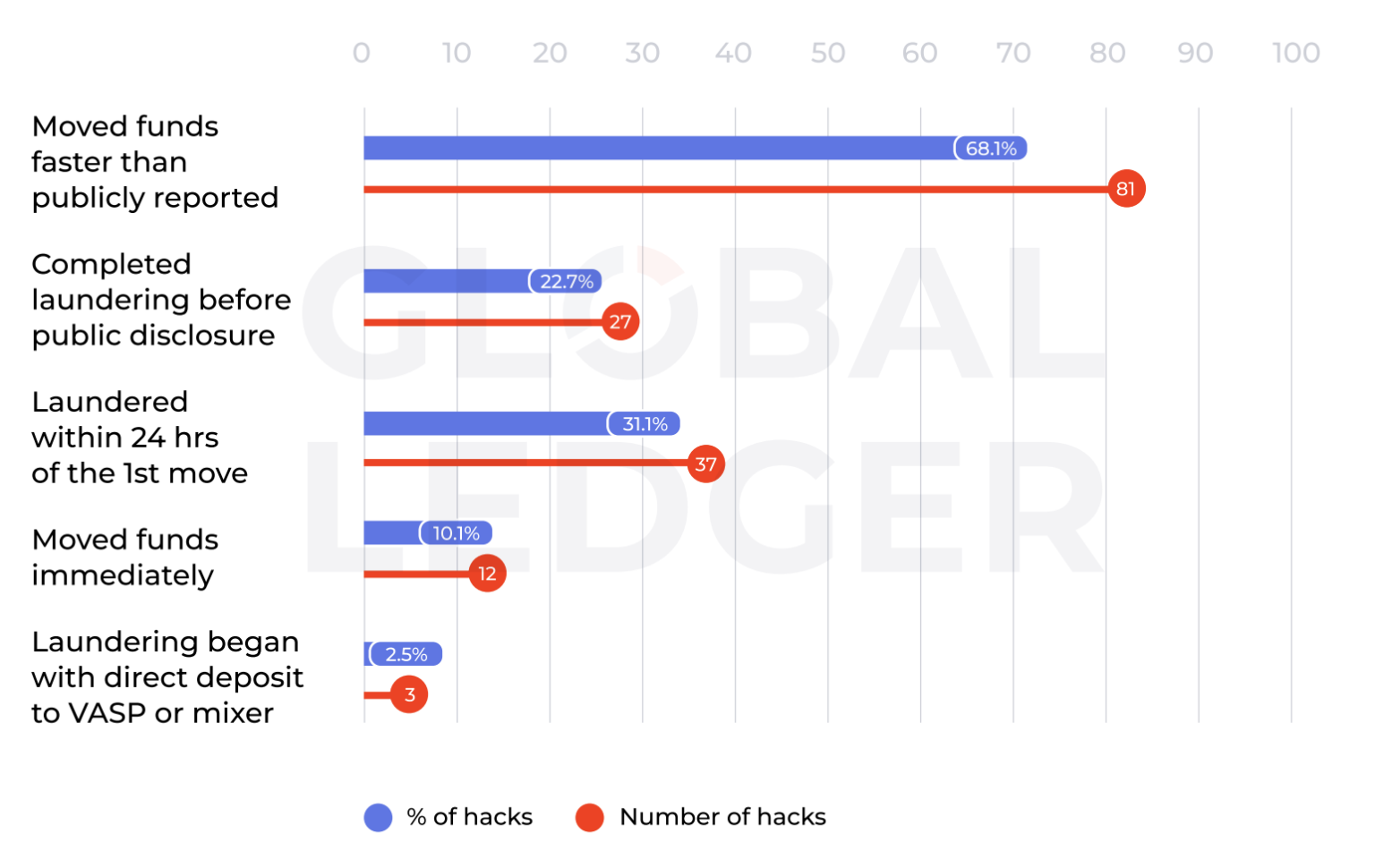

The necessity for stronger surveillance has also been highlighted by means of the speed of illicit hobby. A Global Ledger examine discovered that crypto criminals were able to move stolen funds in four seconds of an attack, a long way outpacing the detection systems of essential exchanges.

In a few cases, laundering become finished in underneath three minutes, well before public disclosures were made.

U.S. Regulators Push Forward on Crypto Oversight Amid Rising Hacks

The U.S. Treasury Department and the Commodity Futures Trading Commission (CFTC) are increasing efforts to build new safeguards for digital assets, as crypto-associated crime persists to outpace detection systems.

On August 19, the Treasury opened a 60-day public comment period under the currently passed GENIUS Act, searching for enter on tools along with artificial intelligence, blockchain monitoring, digital identity verification, and APIs to support financial institutions fight money laundering.

The program follows a surge in crypto crime, with with $3 billion stolen across 119 incidents in the first half of 2025 alone. Treasury Secretary Scott Bessent called the GENIUS Act “crucial” to protecting U.S. Digital asset leadership and increasing regulated dollar-based stablecoins globally.

lately data emphasize the challenge regulators face. According to blockchain analytics company Global Ledger, hackers can move stolen funds in as little as four seconds, kind of 75 times faster than trade alert structures respond.

In over two-thirds of cases, assets have been transferred before the incidents became public, with a few laundered in below 3 mins.

Parallel to the Treasury’s efforts, the CFTC has launched a “crypto sprint” to improve spot crypto law. Acting Chair Caroline Pham said the 4-phase program, running along the SEC’s Project Crypto, ambitions to launch instant federal-level trading of digital property.

Public comments are due by October 20, with very last policies anticipated in the program’s concluding segment. The attempt builds on an August 5 proposal to allow spot crypto trading on federally registered exchanges, a part of pointers from the President’s Working Group on Digital Asset Markets.

The CFTC, however, faces uncertainty at the leadership stage. Commissioner Kristin Johnson will step down September 3, leaving Pham as the sole member of the commonly 5-person organization. Pham is also expected to exit as soon as President Trump’s nominee Brian Quintenz is confirmed, with reports linking her to crypto payments firm MoonPay.