Bitwise CIO Matt Hougan and Grayscale expect Bitcoin will break its traditional 4-year cycle and hit latest all-time highs in 2026, led by institutional capital flows, regulatory clarity, and structural market transformation.

Considerable asset managers are predicting that Bitcoin will shatter its traditional 4-year cycle and attain latest all-time highs in 2026, led by huge institutional capital inflows and regulatory clarity.

Bitwise Chief Investment Officer Matt Hougan and Grayscale Research both venture BTC will surpass its earlier peak in spite of conventional wisdom assisting 2026 should be a pullback year.

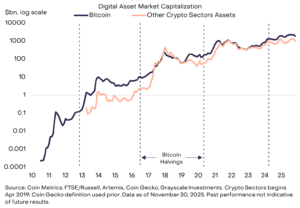

Bitcoin has historically followed a 4-year cycle tied to halving events, with three huge up years accompanied by sharp corrections.

Since the latest halving happened in April 2024, more than 18 months ago, traditional cycle theory would expect 2026 as a down year.

Moreover, Hougan claims that the forces leading preceding cycles have weakened significantly, while new structural dynamics are taking hold.

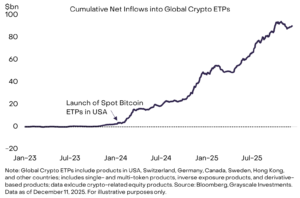

“We accept as true with the wave of institutional capital that started coming into the space with the approval of spot bitcoin ETFs in 2024 will boost in 2026, as platforms like Morgan Stanley, Wells Fargo, and Merrill Lynch start allocating,” Hougan wrote in Bitwise’s annual predictions report.

He anticipate Bitcoin to attain latest all-time highs, relegating the 4-year cycle to the dustbin of history.

Institutional Era Replaces Retail-Driven Volatility

Grayscale’s 2026 outlook echoes this change, projecting Bitcoin will set latest records in the first half of next year as the market transitions into what it calls the institutional era.

The asset manager recognize 2-pillars assisting this view:

- Macro require for optional stores of value amid increasing public debt

- Fiat currency risks, plus enhancing regulatory precision that deepens blockchain incorporation with traditional finance.

The transforming market structure has already changed Bitcoin’s price conduct. Earlier bull markets saw profits increasing 1,000% in a single year, while this cycle’s maximum year-over-year growth almost reached 240% by March 2024.

Grayscale attributes this moderation to steadier institutional buying in preference to retail momentum chasing, claiming the probability of deep, extended drawdowns has declined considerably.

Grayscale anticipate growing valuations in the crypto sector in 2026, and as a result, Bitcoin should surpass its earlier high in the first half of the year.

Bitwise’s evaluation also emphasize how Bitcoin uncertainly has step by step reduced over the last decade, with BTC now much less unstable than Nvidia during 2025.

Hougan expects Bitcoin’s correlation with stocks will fall in 2026 as crypto-precise factors like regulatory development and institutional adoption power the asset higher even if equities struggle.

Regulatory Clarity and Monetary Policy Alignment

Katherine Dowling, president of Bitcoin Standard Treasury Company, latest forecast that Bitcoin would reach $150,000 by the end of 2026, mentioning “the trifecta of a positive regulatory environment, quantitative easing, and institutional inflows.”

President Trump currently signed the GENIUS Act, establishing stablecoin regulatory framework, while the Office of the Comptroller of the Currency allowed national banks to provide crypto brokerage services.

Just this month, Bank of America now allows its financial advisers to recommend Bitcoin ETFs, possibly channeling portions of the bank’s $3.5trillion in customer assets into digital assets.

The Federal Reserve cut rates 3-times in 2025 and anticipate to keep easing next year.

Particularly, Grayscale anticipates bipartisan crypto market structure law to emerge as US law in 2026, with a purpose to solidify blockchain-primarily based finance in capital markets.

Since US Bitcoin ETPs released in January 2024, global crypto ETPs have attracted $87 billion in net inflows, but less than 0.5% of US advised wealth is allocated to crypto.

On the technical level, as per a CryptoQuant analyst, on-chain data indicates long-term period holders allocating coins at one of the biggest 30-day rates in the past 5 years, generally demonstrating late-cycle behavior.

Moreover, CryptoQuant data also indicates short-time holders are dealing with pressure, as Bitcoin has traded below their $104,000 price basis since October 30, resulting in unrealized losses averaging 12.6%.

As reported by Cryptonews today, Bitcoin dropped nearly 4% to about $85,940 amid investor risk reduction in advance of important US economic data.

In spite of near-term volatility, like other big players, Bitfinex maintains that the groundwork is being laid for BTC to regain all-time highs in 2026, assisted by looser monetary policy and strong adoption by ETFs, corporates, and sovereign entities which might be absorbing multiples of the yearly mined supply.