Natural language processing in finance can extract and analyze unstructured data by using OCR, sentiment analysis, named entity recognition, and topic modeling applications

With the rising digital payments being made across the globe how can financial organizations ensure maximum sales conversion and payment acceptance, as well as minimize risk exposure? Sounds alarming?

In the finance industry that is highly reliant on data processing and information maintaining a marginal edge and understanding the natural nuance of customers to provide on-time resolution requires AI-related technology.

As per Gartner, AI technologies like Natural Language Processing (NLP) are gaining traction from businesses to create new products, improve existing products and enhance customer base.

This rapid evolution is driven by two factors: Firstly, having grown accustomed to virtual assistants like Siri in their daily lives, customers accept the same in their workplace. Second, today NLP is no longer reliant on rules-based processes, with Machine learning, NLP allows greater scalability and accuracy. Let’s have an in-depth look at natural language processing and how NLP is a sure-shot solution to make data-driven decisions in real time.

Read More:- Why Employing Programming Language R in your Data Science Projects come as your best bid?

Understanding Natural Language Processing

Natural Language Processing is a subset of artificial technologies that use machine learning algorithms to enable computers to understand, interpret, and comprehend the natural nuance of human context.

Organizations using chatbots and virtual assistance can leverage NLP to mine insights from the vast amount of data and understand the user’s natural language query inputs. NLP for financial documents can be a game-changer.

For example, financial professionals spend a lot of time reading financial press, analyst reports, and other sources of information. NLP can help design a system that can make informed decisions in real time by converting unstructured data into textual format with minimal human intervention.

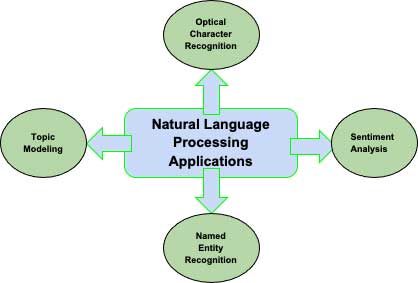

Top Applications of Natural Language Processing in Finance

However, there is a wide range of NLP applications but some of them stand to benefit the most in the finance sector. Let’s dig in-

Optical Character Recognition (OCR)

In financial organizations, dealing with a pile of data is a common occurrence. Corporate filings, Research And analytics reports, and quarter revenue transcripts are some of the financial documents that financial analysts need to paddle through.

The piling of unstructured data (ex- pdf, email, images, text,) makes the analysis more time-consuming and tedious. At this juncture, optical character recognition allows you to convert unstructured financial datasets into a digestible format to be fed into the NLP pipeline for further analysis.

Read More:- Working Of Machine Learning In AI Paraphrasing Tools

Natural Language Processing – Sentiment Analysis

Valuable customer experience is paramount to any financial organization. However, by using Conversational AI chatbots financial institutions can keep an eye on the voice of the customer.

But, the underlying sentiment behind a customer’s voice can only be determined by sentiment analysis.

Sentiment analysis algorithms detect customer pain points and their emotional quotients, allowing the financial institution to design the policy and services as per customer interest.

Over time, this information can be consolidated to offer personalized financial products and services to customers.

Named Entity Recognition

Regardless of which organizations a customer interacts with, data privacy and security are top concerns. And the financial industry is jam-packed with the processes like credit risk management, underwriting, and loan disbursal that require huge human effort and fraud prevention.

Using named entity recognition enable the finance sector to go beyond the sentiment analysis, and detect real-life concepts like a specific person, company name, location, organization, and others.

By collecting the extracted information NLP datasets can easily compare the customer information in their database and create an alert if it detects fraud and money laundering.

Topic Modeling

Due to irregular non-classified data, and seasonal variations, predicting time series for financial analysis is a complicated task.

However, the machine learning-enabled topic modeling approach can provide semantically structured data by classifying common words and phrases and grouping them for easy financial analysis and marketing decisions.

That’s how NLP provides precise workflow automation for the financial manager in lower turnaround time.

Read More:- Introducing Metaverse: A Glimpse into its Crucial Characteristics

Future of NLP in Finance

With NLP in finance, the future is bright, and your financial institution should be too. From taking over mundane and repetitive tasks to providing robust financial analysis support, NLP allows finance organizations to effectively ensure regulatory compliance and gained increased market insights. It’s high time for financial organizations to make a transition from smart to smarter. Because the longer you procrastinate, the faster you lose the game.