Billionaire Michael Saylor’s Strategy has introduced some other 22,305 bitcoin to its balance sheet spending about $2.13 billion as the corporate continues its aggressive accumulation strategy.

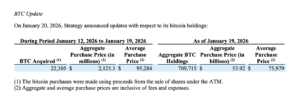

The purchase disclosed on January 20, follows sales performed beneath Strategy’s at-the-market (ATM) equity and selected stock programs among January 12 and January 19, 2026. The bitcoin became obtained at an average price of $95,284 per BTC, which includes fees and expenses.

As of January 19, Strategy now holds a total of 709,715 bitcoin received for around $53.92 billion at an average price of $75,979 per BTC.

ATM Program Funds Recent Bitcoin Acquisition

As per the filing, Strategy increased about $2.125 billion in net carries on during the time by a combination equity and preferred stock issuance. The majority of capital was formed thru sales of STRC variable-rate preferred stocks and MSTR Class A common stock.

Significantly, Strategy sold 2.95 million STRC shares for $294.3 million in net proceeds and published 10.4 million MSTR shares, producing $1.83 billion. Smaller amounts were raised by STRK favored stock sales, at the same time as no issuance under STRF or STRD during the period.

The corporation confirmed that proceeds from the ATM program have been used directly to fund bitcoin purchases, strengthening its long-standing capital markets-to-bitcoin conversion strategy.

Bitcoin Holdings Continue to Scale

With the recent acquisition, Strategy’s bitcoin holdings have increases by more than 22,000 BTC in a single week, cementing its position as the largest company holder of bitcoin globally.

At recent levels, the organization’s combine holdings indicates 3% of bitcoin’s total circulating supply. While the average buying rate of current acquisitions sits above Strategy’s historic cost basis, management has repeatedly and again highlighted long-term accumulation over short-term price sensitivity.

The disclosure indicates that even as the recent tranche was obtained near current market highs, Strategy’s blended acquisition price stays materially lower because of earlier purchases made at discounted levels.

Capital Markets Strategy Remains Intact

Strategy’s persisted use of preferred stock issuance and equity sales displays a planned effort to diversify funding resources while minimizing operational cash flow dependence.

The corporation still has more than $8.4 billion of MSTR stock and billions in preferred securities available for future issuance below its ATM programs.

In spite of heightened volatility in crypto markets and ongoing regulatory uncertainty, Strategy has maintained its bitcoin-centric capital allocation framework, positioning BTC as its number one treasury reserve asset.

Long-Term Conviction Unchanged

The modern day buy suggests Strategy’s unwavering conviction in bitcoin as an extended-period store of price and financial asset. By systematically changing capital raised in conventional markets into bitcoin publicity, the corporation continues to perform as a leveraged proxy for institutional bitcoin adoption.

As of January 19, Strategy’s balance sheet displays now not scale but persistence — a defining features of its approach as bitcoin enters a more institutionally driven phase of market maturity.