AI memory demand has flip SK Hynix to a top role within the global DRAM market, overtaking longtime leader Samsung for the first time.

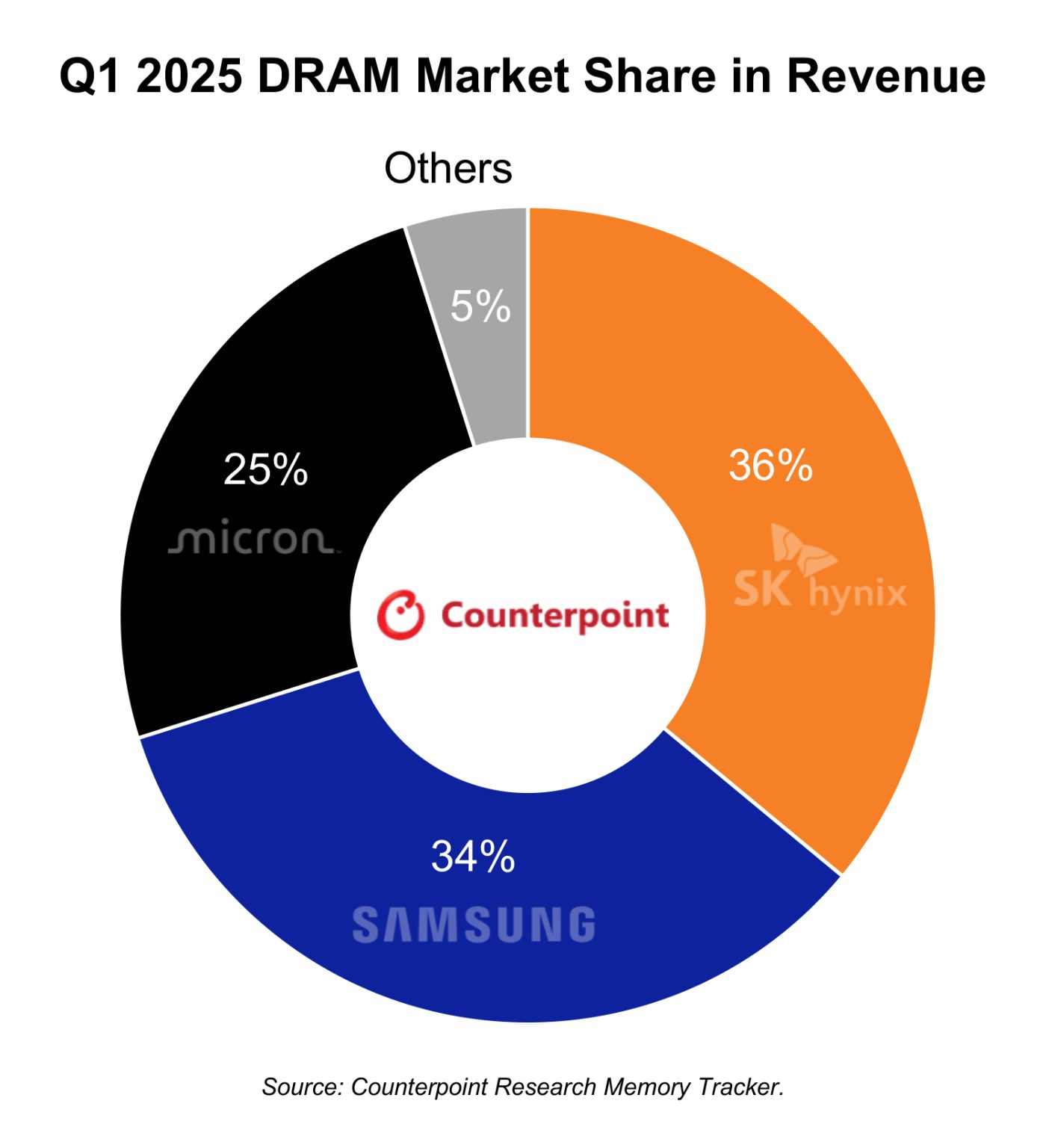

According to Counterpoint Research data, SK Hynix captured 36% of the DRAM market in Q1 2025, as equated to Samsung’s 34% share.

HBM chips drive market shift

The enterprise’s success ends Samsung’s 3 decade dominance in DRAM production and comes shortly after SK Hynix’s operating profit exceeded Samsung’s in Q4 2024.

The enterprise’s key target on high-bandwidth memory (HBM) chips, critical components for artificial intelligence programs, has established to be the decisive factor in the market shift.

“The is a milestone for SK Hynix which is sucessfully turning on DRAM to a market that maintains to show unleashed need for HBM memory,” stated Jeongku Choi, senior analyst at Counterpoint Research.

“The production of specialized HBM DRAM chips has been notoriously problematic and those that got it right early on have reaped dividends.”

SK Hynix has taken the overall DRAM market lead and has mounted its dominance in the HBM sector, involving 70% of this high-value market section, in line with Counterpoint Research.

HBM chips, which stack more than DRAM dies to dramatically boost statistics processing capabilities, have grow to be fundamental components for training AI models.

“It’s another wake-up call for Samsung,” stated MS Hwang, research director at Counterpoint Research in Seoul, as quoted by means of Bloomberg. Hwang referred to that SK Hynix’s leadership in HBM chips probable contained a bigger part of the enterprise’s operating income.

Financial overall performance and industry outlook

The enterprise is anticipated to report good financial result on Thursday, with analysts projecting a 38% quarterly upward push in sales and a 129% increase in operating profit for the March quarter, in according with Bloomberg data.

The shift in marketplace leadership reflects broader adjustments in the semiconductor industry as AI programs pressure demand for specialized memory solutions.

While traditional DRAM stays important for computing gadgets, HBM chips that could cope with the great statistics necessities of generative AI systems are becoming more and more valuable.

Market research firm TrendForce forecasts that SK Hynix will keep its leadership position at some point of 2025, coming to govern over 50% of the HBM market in gigabit shipments.

Samsung’s share is anticipated to decline to below 30%, even as Micron Technology is stated to benefit ground to take close to 20% of the market.

Counterpoint Research anticipated the overall DRAM market in Q2 2025 to keep comparable patterns throughout section growth and seller share, suggesting SK Hynix’s newfound leadership position can be sustainable in the near term.

Navigating potential AI memory call for headwinds

Despite the recent AI memory call for boom, industry analysts identify numerous demanding situations on the horizon. “Right now the world is focused on the impact of tariffs, so the query is: what’s going to happen with HBM DRAM?” stated MS Hwang.

“At least in the quick term, the segment is less probably to be tormented by any trade shock as AI call for ought to continue to be robust. More considerably, the end product for HBM is AI servers, which – by definition – can be borderless.”

However, longer-term dangers remain significant. Counterpoint Research sees potential threats to HBM DRAM market growth “stemming from structural challenges added on trade shock that could cause a recession or even a depression.”

Morgan Stanley analysts, led by way of Shawn Kim, expressed comparable sentiment in a notice to investors cited by Bloomberg: “The actual tariff impact on memory resembles an iceberg, with most danger unseen under the surface and nevertheless approaching.”

The analysts cautioned that earnings reports might be overshadowed via these large macroeconomic forces. Interestingly, despite SK Hynix’s present day advantage, Morgan Stanley still favours Samsung as their pinnacle pick within the memory sector.

“It can higher face up to a macro slowdown, is priced at trough multiples, has optionality of future growth through HBM, and is purchasing back shares every day,” analysts wrote.

Samsung is scheduled to offer its whole financial assertion with net income and divisional breakdowns on April 30, after reporting preliminary operating income of 6.6 trillion won ($6 billion) on revenue of 79 trillion gained in advance this month.

The shift in competitive positioning between the 2 South Korean memory giants underscores how specialized AI components are reshaping the semiconductor industry.

SK Hynix’s early and aggressive funding in HBM technology has paid off, although Samsung’s great resources make sure the rivalry will hold.

For the wider technology ecosystem, the change in DRAM market leadership signals the growing significance of AI-precise hardware components.

As statistics centres worldwide retain expanding to guide increasingly-sophisticated AI models, AI memory call for should stay robust in despite of potential macroeconomic headwinds.