Despite its traditionally danger-averse nature, the insurance industry is being fundamentally reshaped with the aid of AI.

AI has already turn out to be important for the insurance industry, touching the whole lot from complex hazard calculations to the way insurers speak to their customers. However, while nearly eight out of ten companies are dipping their toes within the AI water, a similar number admit it hasn’t truly made them any extra money.

Such figures disclose a simple reality: just purchasing the fancy new tech isn’t sufficient. The actual winners may be the ones who figure out a way to weave it into the very fabric of who they’re and the entirety they do.

You can see the most dramatic modifications proper at the heart of the business: handling claims. That mountain of paperwork and countless smartphone calls, a method that might drag on for weeks, is sooner or later being bulldozed by AI.

A deployment via New York-based insurer Lemonade back in 2021 resulted in settling over a third of its claims in only 3 seconds, without a human input. Or study a major US travel insurer that handles 400,000 claims a year; it went from a totally manual system to one which was 57% automated, reducing down processing times from weeks to just minutes.

However, this isn’t pretty much moving quicker; it’s about getting it proper. AI can cut down the sort of expensive human errors that result in claims leakage in the insurance industry via as much as 30%. The knock-on impact is a large productiveness leap, with adjusters capable of deal with 40-50% more cases. This frees up the actual experts to stop being paper-pushers and start concentrating on the problematic cases wherein a human contact and actual empathy make all of the difference.

It’s a same story for the underwriters, the people who calculate the dangers. AI is giving them superpowers, allowing them to examine huge amounts of data from all types of places – like telematics or credit scores – that someone may want to in no way sift by alone. It may even draft an preliminary risk report with remarkable accuracy by means of searching at past data and guidelines in the blink of a eye.

In exercise, this supports create pricing this is fairer and more as it should be reflects a person’s specific scenario. Zurich, as an example, used a modern-day platform to construct a threat management device that made their assessments 90% more accurate.

Suddenly, underwriting isn’t about looking in the rearview mirror anymore—it’s a residing, breathing technique that may adapt on the fly to new, complicated threats like cyberattacks or the effects of climate change.

But this isn’t just about back-office wizardry. When deployed within the insurance industry, AI is absolutely converting the conversation among insurers and the humans they serve. It’s permitting a move away from simply reacting to problems to proactively supporting clients.

AI chatbots can provide 24/7 guide, getting smarter with every query they answer. This lets the human group concentrate on the more tough conversations. The real game-changer, although, is making things personal.

By undderstanding a customer’s policy and behavior, AI can gently nudge them with a renewal reminder or suggest a product that without a doubt fits their life, like usage-based totally car insurance. It’s about displaying clients you certainly get them, which builds the kind of loyalty that’s been so tough to come back by in an industry in which over 30% of claimants feel dissatisfied, and 60% blame slow settlements.

This defensive instinct also support the complete system. AI is a wonderful fraud detective for the insurance industry and beyond, spotting weird patterns in data that someone could omit, and has the potential to reduce fraud-associated losses by to 40%. It keeps everyone honest and protects the business and its clients.

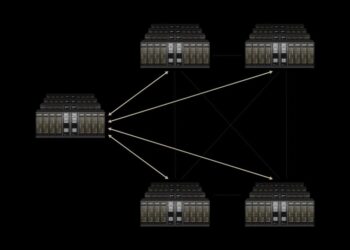

What’s pouring fuel on this fire of change? A new breed of low-code systems. They are the accelerators, letting insurers construct and introduce new apps and offerings a lot faster than before. In a world where client tastes and guidelines can alternate overnight, that sort of speed is everything.

The best a part of such tools is that they democratize access and positioned the power to innovate into more hands. They permit ordinary business users – or ‘citizen developers’ – to build the t tools they want without having to be coding geniuses. These platforms often come with strong protection and controls, that means this newfound speed doesn’t must suggest sacrificing protection or compliance, which is non-negotiable for an industry like insurance.

When you step back and look at the big picture, it’s clear that obtaining on board with AI isn’t only a tech venture; it’s a make-or-break business strategy. Those who jumped in early are already pulling away from the pack, seeing things like a 14% bounce in consumer retention and a 48% upward push in Net Promoter Scores.

The market for this technology is set to explode to over $14 billion dollars by 2034, and a few believe AI should add $1.1 trillion in value to the industry each year. But the largest roadblocks aren’t about the technology itself; they’re about people and old habits.

Data, specially in an industry like insurance, is frequently caught in old systems which stops AI from seeing the whole picture. To get beyond this, you want more than clever software. You want leaders with a clear vision, a willingness to change the company culture, and a commitment to training their people.

The winners in this new era won’t be the ones tinkering with AI in a corner—they’ll be the ones who lead from the top, with a clear plan to make it a part of their DNA. This will need an understanding that it’s now not just about doing old things better, but about locating entirely new methods to bring value and build trust.